Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9780521851121: Schenk, Alan, Oldman, Oliver: Books

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Value Added Tax Musaad Alwohaibi Musaad@ufl.edu Tuesday (8:15-10:15 a.m.) (Jan. 13 through Feb. 18) 2-credits Office Hours : Tue

Value Added Tax: A Comparative Approach (Cambridge Tax Law Series) - Kindle edition by Schenk, Alan, Thuronyi, Victor, Cui, Wei. Professional & Technical Kindle eBooks @ Amazon.com.

Value Added Tax: A Comparative Approach (Cambridge Tax Law Series) - Kindle edition by Schenk, Alan, Thuronyi, Victor, Cui, Wei. Professional & Technical Kindle eBooks @ Amazon.com.

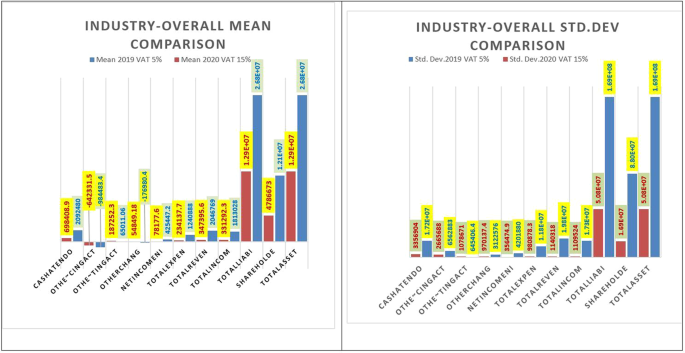

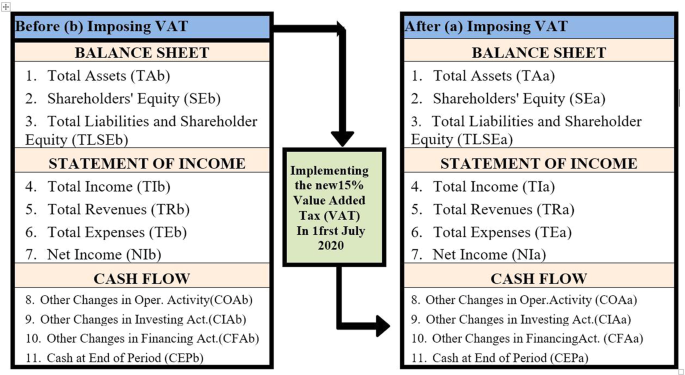

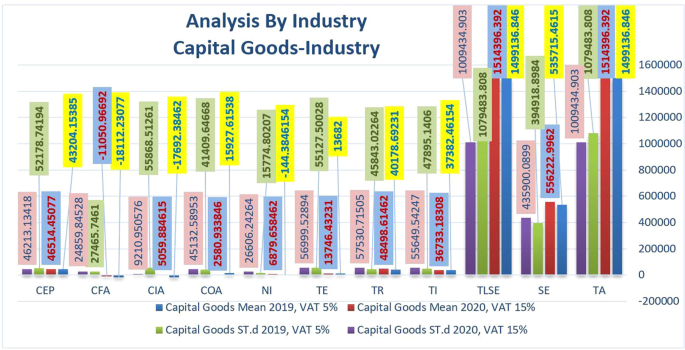

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Amazon.com: Value Added Tax: A Comparative Approach (Cambridge Tax Law Series): 9781107617629: Schenk, Alan, Thuronyi, Victor, Cui, Wei: Books

![PDF] THE ECONOMIC AND SOCIAL IMPACT OF THE ADOPTION OF VALUE-ADDED TAX IN SAUDI ARABIA | Semantic Scholar PDF] THE ECONOMIC AND SOCIAL IMPACT OF THE ADOPTION OF VALUE-ADDED TAX IN SAUDI ARABIA | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/6ff059c99a8f4eba21eec716b24a43c2b8923812/3-Figure1-1.png)

PDF] THE ECONOMIC AND SOCIAL IMPACT OF THE ADOPTION OF VALUE-ADDED TAX IN SAUDI ARABIA | Semantic Scholar

VALUE ADDED TAX: A COMPARATIVE APPROACH, SECOND EDITION. By ALAN SCHENK, VICTOR THURONYI, and WEI CUI

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

Value Added Tax: A Comparative Approach, With Materials & Cases: 9781571051707: Schenk, Alan, Oldman, Oliver: Books - Amazon.com

Amazon.com: Value Added Tax: A Comparative Approach, With Materials & Cases: 9781571051707: Schenk, Alan, Oldman, Oliver: Books

:max_bytes(150000):strip_icc()/comparative-advantage-4199071-04ccb37cbf71441ea5264d2c07a48fab.png)